fpiplworld@gmail.com. +91 8800-027-600 | 0124-7178-138

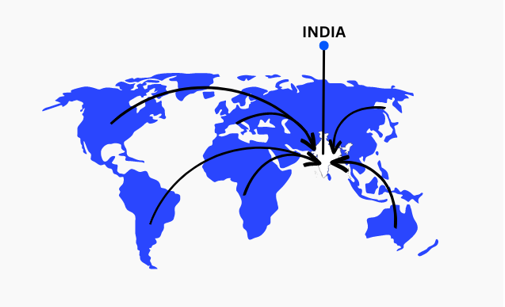

FPIPL specialize in the imports and distribution of exclusive brands

We provide technical aid and training to our customers / salons / distributors enabling them to sell products efficiently. The company has technically qualified personnel for promoting the wide product range which includes Hair Care, to its loyal & valued customer base, which includes all the leading Studios and Salon chains. We also aid large scale distribution of hair care products across the country with our Distribution partners strategically located across the country.

Our Founder

Company MD Profile: Mr. Bhaskar Bawa

Name: Mr. Bhaskar Bawa

Position: Managing Director

Experience: 18+ Years

Industry: Import-Export, Brand Creation, Manufacturing

Mr. Bhaskar Bawa is a visionary leader with over 18 years of unparalleled experience in the import-export sector, both in India and internationally. His expertise spans across global markets, where he has successfully navigated complex trade dynamics, establishing himself as a prominent figure in the industry.

As a brand creator, Mr. Bawa has been instrumental in launching and nurturing several successful brands, including *Freecia Professional, PROADS Professional, Teylie Professional, and Colornow Professional*. Under his guidance, these brands have become household names, known for their quality and innovation in the hair care industry.

Beyond his accomplishments in trade and brand creation, Mr. Bawa is now stepping into the role of an industrialist. He has recently established a state-of-the-art manufacturing facility in Manesar, covering 12,000 square feet. This cutting-edge unit is a testament to his commitment to innovation and excellence, positioning his company at the forefront of the hair care and cosmetics industry.

Preeti Manan, the innovative minds driving Freecia Professional’s success, were recently interviewed by the esteemed host of the International Business Awards (IBA). In this captivating dialogue, the founders shared their transformative journey, offering insights into their entrepreneurial vision and the driving forces behind Freecia Professional’s remarkable achievements. During the interview, Preeti Manan delved into the inception of their company, highlighting their unwavering commitment to innovation and excellence. They discussed the challenges they encountered, the strategies that fueled their growth, and the pivotal moments that shaped their path to success. The founders’ conversation with the IBA host shed light on the core values that have propelled Freecia Professional to the forefront of the business landscape. They emphasized the importance of adaptability, customer-centricity, and staying ahead of industry trends in a rapidly evolving market. Furthermore, Preeti Manan shared their thoughts on the role of leadership in fostering a culture of innovation within their organization. They spoke passionately about the collaborative spirit that drives their team and how they prioritize continuous learning and development.